This list of easy-approval net-30 accounts will accept most new businesses. So, if you’re looking to build your business credit from the ground up, this is the perfect place to start. For each vendor, we included what you need to qualify for a net-30 account. It also includes the business credit bureaus that they report …

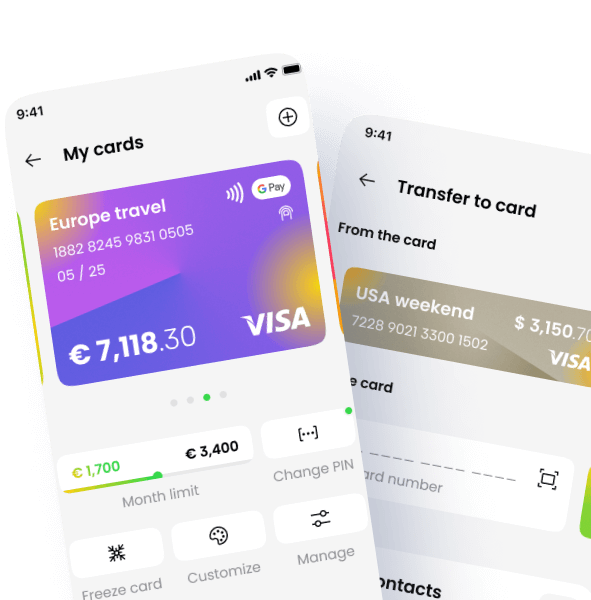

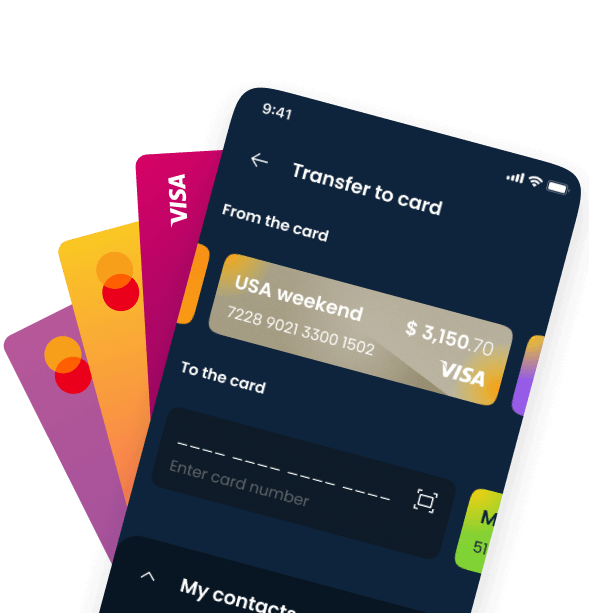

Real bank right in your smartphone

Digital Banking Made Simple

How to Get Started?

1

Order a card

2

Scan the QR code in the envelope with the card

3

Install the application and follow the instructions

4

The card is ready to use

Secure, convenient banking with our mobile app

Operate your accounts in smartphone

Why You Need Digital Banking?

When you're ready, we're ready with a Cyberbank High-Yield Savings Account. Save more with no limit on earnings.

- Pots for separating money Put money aside from your balance

- Award-winning support Through the app, if you need it

- Instant notifications See when, where and how you spend

Pay quickly and conveniently

You no longer have to wait for the bill, the terminal and transfer tips to the waiter's card

It’s easier as ever!

Personal and business banking, at your fingertips

Choose Special Credit Card for You

No, Silicon Valley - bugs are not features. Reach out about a technical issue, share your feedback or ask us about our favorite lunch spot in Miami. We’re here no matter what.

The Bank supports clients engaged in a variety of global capital market activities, bridging importers & exporters, businesses, and financiers

I’m very impressed with the assistance provided by customer service at Cyberbank! Thank you so much to the customer service team at Cyberbank for making this process easy!

Resources to keep you informed

At first glance, the credit system looks like a classic catch-22. You need to have good credit to qualify for credit accounts, but you need credit accounts to have good credit. It can make figuring out how to build credit when you have none a frustrating challenge – if no one shows you the tricks. …

Credit card errors can significantly reduce your credit score and make it much more difficult to qualify for low-interest credit cards, loans, and other forms of credit. While correcting these errors may not land you a perfect credit score, it can lead to substantially lower interest rates and an easier time obtaining financing. Most people assume …

Using a credit card to build credit is one of the fastest and easiest ways to improve your credit score. Responsibly using credit cards allows you to demonstrate to lenders how you manage credit. If your goal is to build good credit (and avoid bad credit), it’s recommended that you use credit cards and make your payments on …

Business credit can help business owners efficiently run and grow their businesses. Just like personal credit, a company’s credit profile can impact its eligibility for financing and the interest rates it pays. Additionally, business credit could factor into your business’s insurance premiums and ability to get government and corporate contracts. How to Build Business Credit Once you …

If you want to start building or expanding your company’s credit profile, you need business accounts that are reported to at least one business credit bureau. Business lenders are not required to report credit to business credit bureaus, so you need to find lenders that do report. Here are several companies and services that can …

What are you waiting for?

Apply for an award-winning bank account

Start your journey to financial freedom today.